South Africa’s rand going to its biggest get more on a monthly basis as a possible unexpected inflation slowdown spurred traders to readjust their outlook for interest-rate increases, rekindling appetite for any country’s local-currency bonds.

With the individual inflation rate dipping back toward the midpoint from the target range, investors are betting the central bank has room to obstruct a rate hike as being the economy emerges from the first-half recession. Which causes South African debt more inviting, in line with Chris Turner, the London-based head of currency strategy at ING Bank.?

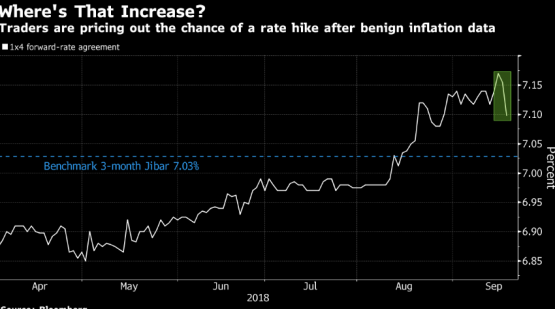

Some analysts speculated that rate increases in Turkey and Russia had added pressure over the South African Reserve Bank to adhere to suit for the battered rand. That view is transforming, with money markets cutting the chances using a rate increase at Thursday’s policy meeting to 28%, from above 50% immediately before the inflation data.

“In benign times, emerging-market investors love the virtuous cycle of lower inflation and unhedged positions within the local-currency bonds,” said Turner. “Obviously these are not benign times, but with investors very short emerging markets and long the dollar, they are often beginning to see some affinity for back in the EM local-currency bond story when a lower inflation print helps. This is the exact opposite of Turkey where inflation continues to rising.”

The rand strengthened 1.2% to 14.72 per dollar by 11:28 am in Johannesburg, leading emerging-market currency gains. Yields on benchmark 2026 rand bonds fell eight basis points, the most since August 14, to 9.12%. That’s still the very best among regional peers except for Turkey, following record outflows on the country’s bond market since April.

Read: South African rates need some Russian rules?

South African inflation slowed in August originating from a 10-month high, with consumer-price growth falling to 4.9% from 5.1% in July, Pretoria-based Statistics Africa said Wednesday from a statement. The median estimate of economists inside a Bloomberg survey was 5.2%.

Only three from 19 economists inside a Bloomberg survey are predicting an interest rate increase on Thursday.